At Riverty, we welcome the introduction of the Consumer Credit Directive (CCD2) as an important step towards strengthening consumer protection and fostering fair and sustainable payment solutions. As a trusted BNPL payment service provider, we believe that robust regulation is essential for creating a strong and transparent ecosystem for you and your consumers alike. We are particularly encouraged by the focus on empowering consumers with better information and safeguards, which aligns with our mission of creating financial solutions that empower everyone.

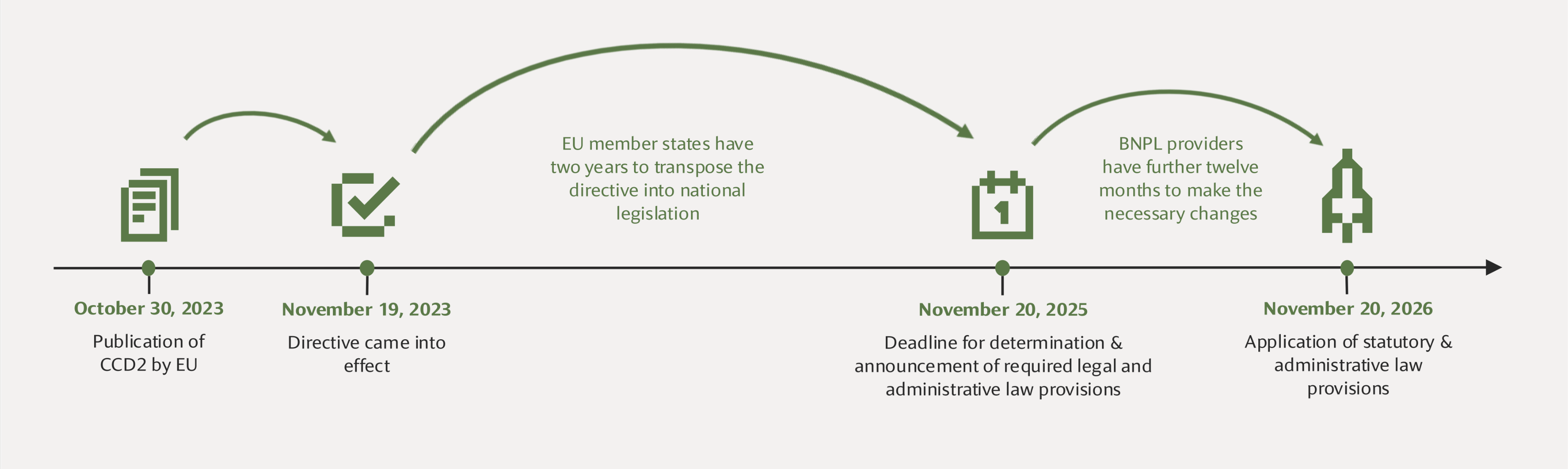

National law interpretations and adaptations across relevant markets will be finalized by 2025, with full clarity on country-specific legislation expected by November 20, 2025.

Riverty is committed to staying informed about all published drafts, actively engaging with the process to ask questions and propose adjustments where necessary. This proactive approach ensures we can deliver the best possible implementation of the regulations for you and your consumers.

Our focus remains on providing transparent guidance and tailored solutions, helping you deliver a seamless and secure payment experience that aligns with the evolving regulatory framework – now and in the future.

Consumer Credit Directive 2 (CCD2)

Do you find this page helpful?