Handle redirect successfully

Redirect flows are more than just a technical integration—they are a strategic advantage for you.

Our redirect flows ensure your stay ahead in an ever-evolving regulatory and technological landscape. From compliance automation to advanced fraud prevention and seamless customer experiences, redirect flows enable you to unlock the full potential of your payment processes.

Features to benefit you:

SCA for fraud prevention:

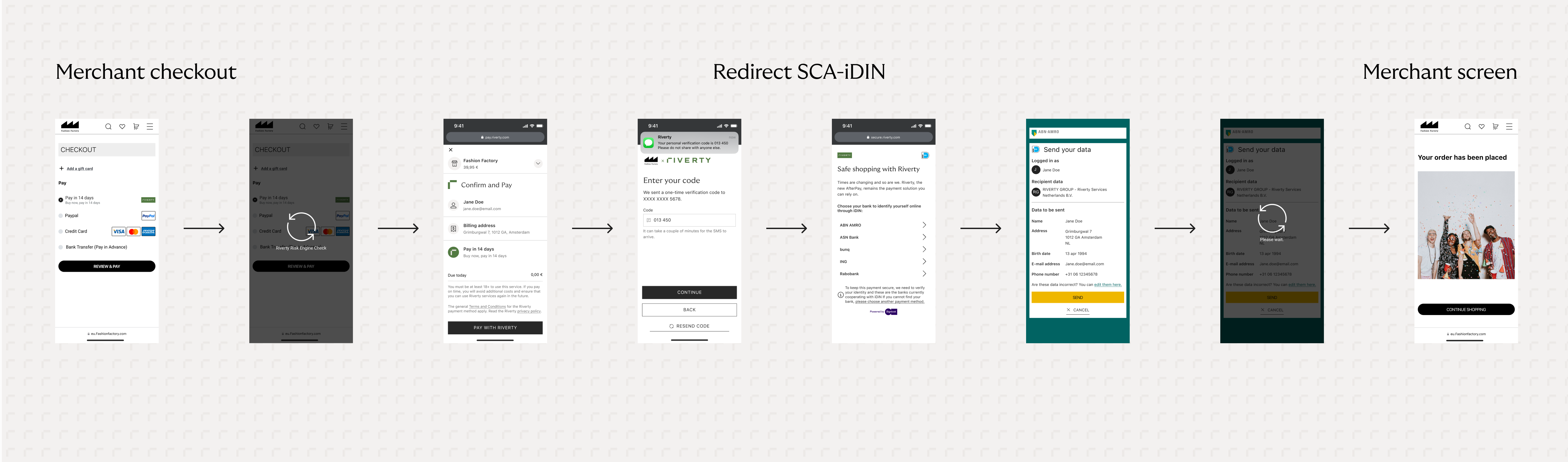

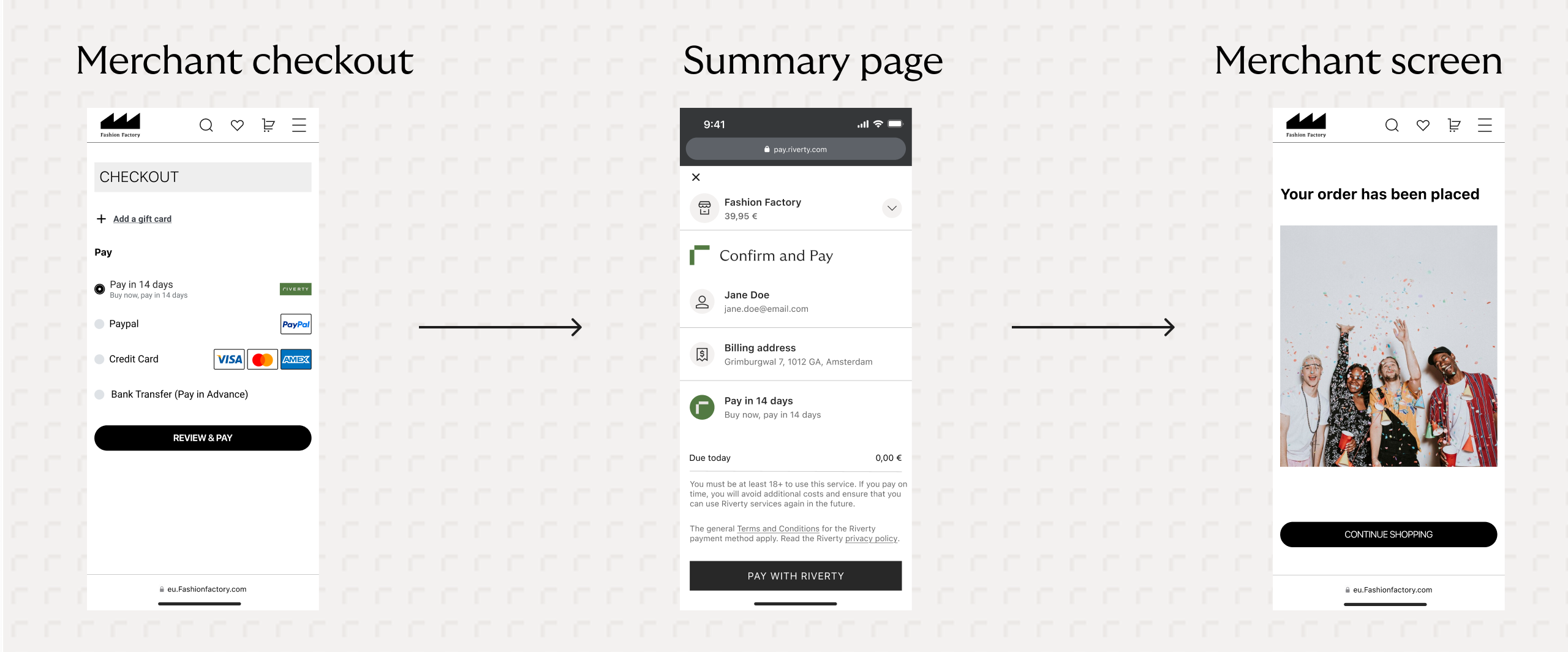

Riverty’s redirect integration enables seamless Strong Customer Authentication (SCA), offering your customers an easy and convenient way to verify their identity and access Riverty’spayment methods.

By implementing SCA, we prioritize customer interests, ensuring protection against non-compliant practices.

Stay ahead of regulatory requirements:

Stay compliant with evolving regulations and reflect all relevant requirements (BNPL Code of Conduct/ as well as future CCD2 requirements) without manual interventions on your side.

Future-Ready Capabilities:

Transitioning to a redirect flow is a simple, one-time setup, seamlessly supporting advanced features like Pay-In-3 or profile tracking.

How to get started:

To support the new asynchronous redirect flow, you need to update your integration to handle redirects properly. Follow our Migration Guide for a step-by-step walkthrough on the required changes.

FAQ:

Redirect flows simplify it all. Not only do they support in creating secure and trusted payment experiences for your customers - redirect also lowers maintenance efforts on your side and assures future-proof payment experiences by meeting regulatory requirements. The redirect flow keeps T&Cs accurate and up to date, safeguarding you from disputes and ensuring you stay ahead of evolving regulatory landscapes. Smooth and transparent checkouts for your customers come hand in hand with redirect. Built-in features like SCA not only protect users and their data but also enhance credibility. By prioritizing security and usability, we help you create shopping experiences with strong acceptance that keep users coming back.

Riverty automates compliance updates (like the BNPL Code of Conduct in NL), so you always meet the latest requirements without additional effort.

Yes, redirect flows integrate seamlessly with all our Riverty features and assures seamless and easy integration of new payment products - for you to continously optimize your payment processes.

A redirect happens throughout the checkout (see screenshow above) and is required to complete the payment process. Redirects are well-established in e-commerce and offer a variety of benefits and simplifications for both you and you customers experience.

Do you find this page helpful?