Dunning Communication

Within Accounting as a Service, the Dunning Communication ensures that consumers are informed about outstanding payments and receive consistent, compliant reminders throughout the dunning process.

Each dunning level can trigger its own communication, enabling businesses to gradually adjust tone and content — from a friendly reminder to a final pre-collection notice.

By communicating clearly and proactively, clients can reduce payment delays, maintain positive consumer relationships, and minimize the need for manual collection efforts.

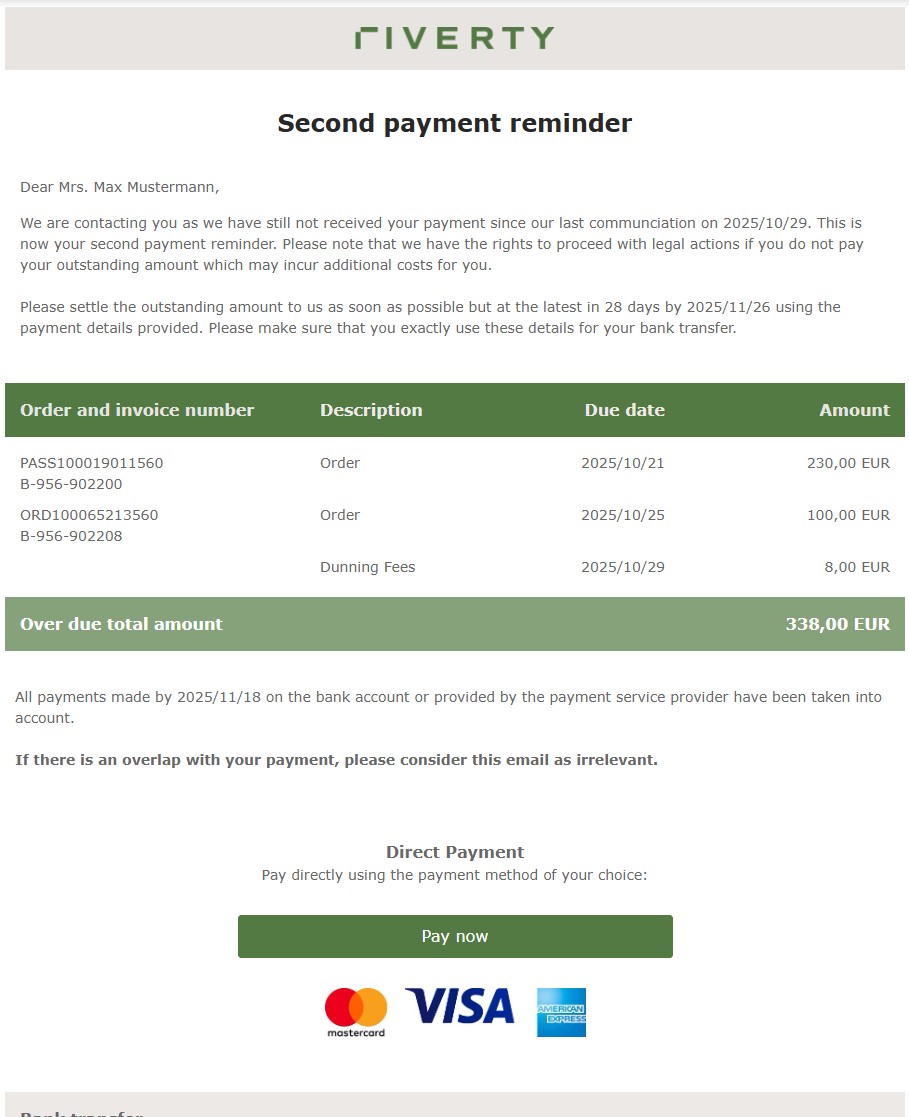

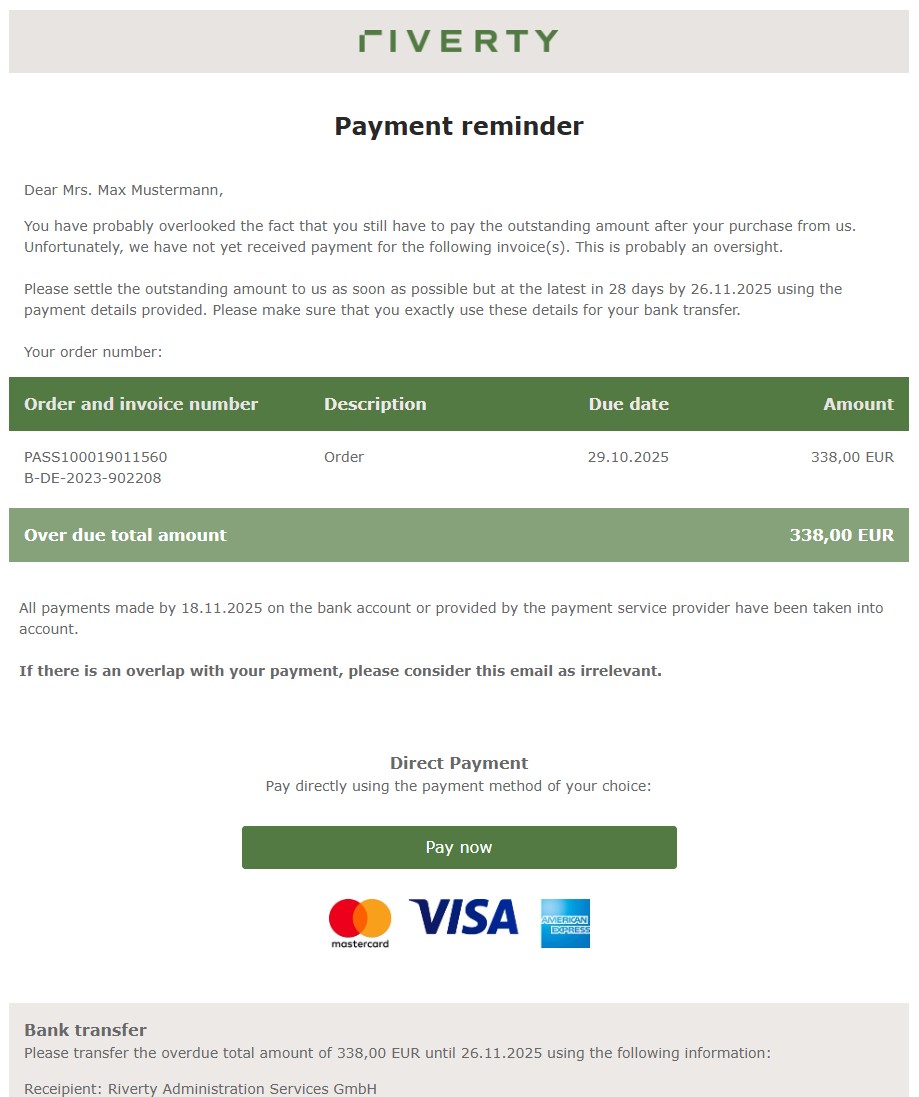

Sample

Key Benefits

Flexible dunning strategy

Each dunning level can have its own template and channel setup — allowing for different tones, messages, and escalation levels.

Multi-channel communication

Dunning notices can be sent as emails (HTML) or printed letters to meet business or regulatory requirements. The standard setup follows a three-step process (reminder → first dunning → last dunning) before handing over to a collection agency.

Process transparency

Consumers are kept informed about outstanding amounts, payment deadlines, and next steps in the process — improving payment behavior and reducing service contacts.

Customizable per business process

Different dunning processes can run in parallel (for example, B2C vs. B2B) with their own thresholds, payment terms, and templates, providing full flexibility to reflect client-specific business rules.

Trigger and Logic

The communication is triggered automatically when the dunning level for a consumer is increased in Accounting as a Service.

Each dunning level in a dunning process can trigger a separate communication.

Suppression Rules

- Dunning blocks: If a dunning block is active, the consumer will not be leveled up in the process and no communication is sent.

- Collection flag: Consumers already in collection will not receive separate dunning messages; their open positions are transferred directly to the collection process (Nachmeldung).

- Disputes: If a dispute case exists, a temporary dunning block prevents new dunning communications until the block is lifted.

The message is generated only when the dunning posting is completed successfully.

Dynamic Message Content

The Dunning Communication can include contextual and dynamic information, such as:

- Outstanding balance and due dates.

- Payment reference and amount due.

- Payment link, if the paypage feature is active (paypageUrlIsActive = X).

- Next process step, for example:

- “Please settle your balance to avoid additional reminder fees.”

- “If payment is not received, your case will be handed over to collection.”

This flexibility enables clients to adapt tone and detail level for each dunning stage — from polite reminders to final notices.

Customization Options

Clients can design their dunning communications according to tone, channel, and language. The following configuration options are available:

- Separate templates per dunning level and process (e.g., reminder, 1st dunning, last dunning).

- Support for multiple communication channels: email (HTML) and printed letter.

- Multi-language templates: each language version is maintained separately.

- Flexible tone of voice: early levels can use a friendly reminder style, while later levels can adopt a more formal escalation message.

- Full white-label design: branding, layout, and contact information can be customized to align with the client’s corporate identity.

- Optional paylink integration: if the paypage feature is enabled, a direct payment link can be displayed to simplify settlement.

Event specific parameters

Accounting as a Service provides a general list of parameters that are communicated for all consumer communications which are documented here.

The following parameters are provided by Accounting as a Service and can be used to personalize the Dunning Communication template.

Clients can decide which of these parameters to include in their message text or design.

- Dunning Date: Date the dunning communication took place

- Last Communication: Date the last communication (previous dunning level) took place (only for dunning level 2+ available)

- Total Dunning Amount: Total overdue amount

- Date of last settlement file import: Date until when the last payment was booked (date of last settlement-import)

- Dunning Payment Advice: Reference text the consumer has to use when transfering the money

- Payment term (date): Payment term for the consumer to settle the open amount

- Payment term (in days): Days until the next communication takes place (reflects the payment term)

- PayPage URL: If activated, the PayPage Link will be provided

Open position - based parameters

- Type of entry: This allows to specify and localize what kind of entry is displayed

- Invoice

- Dunning fee

- Payment related fees (chargeback/declined direct debit)

- Akonto booked payments (not yet cleared)

- Due date: Date until when this open position has to be paid

- Document date: Date when the position was initially booked (usually the invoice date or the date, the decline fee was booked)

- Order number: Order ID, known by the customer, the position relates to. This information is provided in the create order details

- Invoice number: Invoice number known by the customer, the position relates to. This information is provided in the invoice order details