Goodwill Granted Communication

Within Accounting as a Service, the Goodwill Granted Communication informs consumers proactively when a goodwill credit has been created and booked, and which affect this has to their account.

The goodwill may originate either from

- the client directly (Add Goodwill), or

- a manual goodwill creation via MyAccounting.

In both cases, once the posting in Accounting as a Service has been successfully completed, the consumer receives the corresponding communication.

By confirming goodwill transactions automatically, businesses demonstrate transparency and responsiveness, reducing consumer uncertainty and strengthening trust.

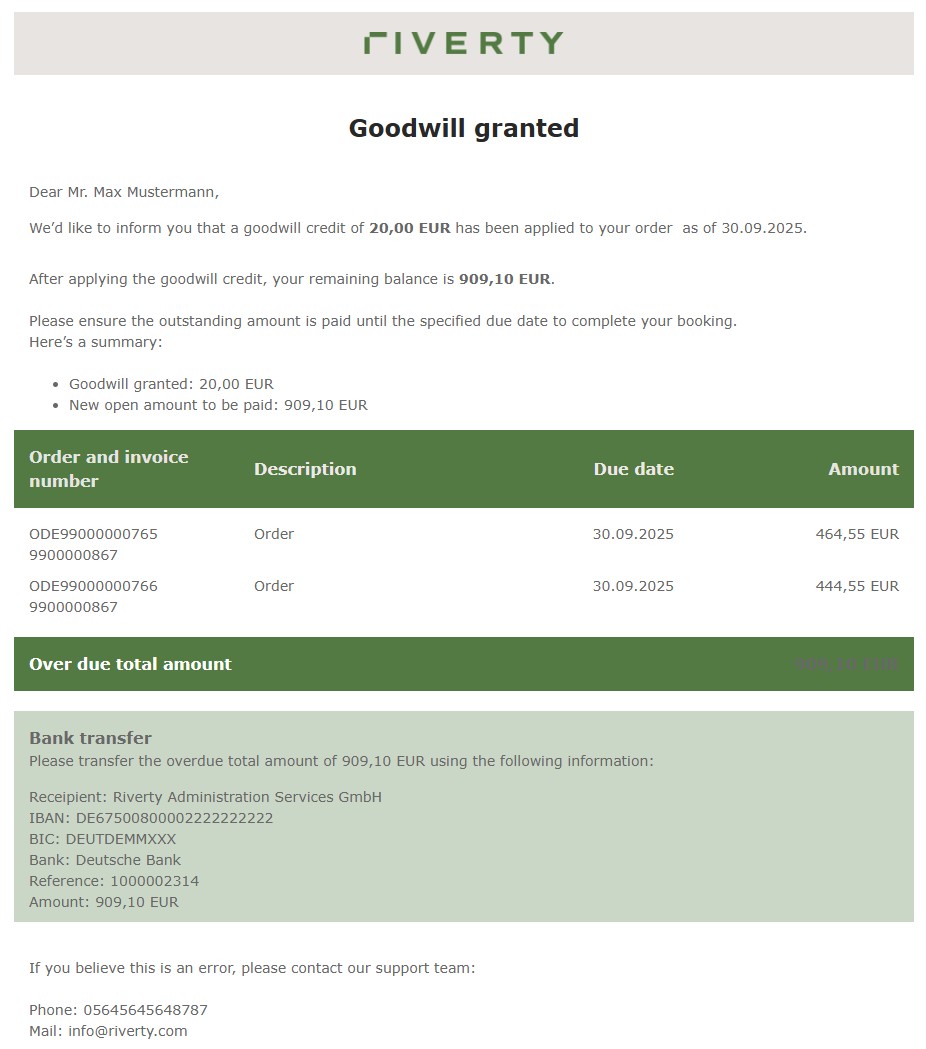

Sample

Key Benefits

Transparent and proactive communication

Consumers are informed as soon as a goodwill credit is successfully applied to their account — improving satisfaction and reducing inbound service requests.

Consumer trust and clarity

The message confirms that a requested or granted goodwill has been processed, providing visibility into the current account status.

Fully customizable templates

Each client defines their own goodwill templates, allowing full control over text, design, and call-to-action elements.

Single, automated communication type

No multiple levels or escalation logic — one goodwill event equals one message, triggered automatically after booking.

Trigger and Logic

The communication is triggered automatically when a goodwill has been successfully booked in Accounting as a Service.

This applies both to goodwills received from the client via interface and to those created manually in MyAccounting.

Suppression Rules

- Disabled if the consumer’s account has a collection flag.

- Disabled if the booking is older than 72 hours to avoid sending outdated information.

The message is generated only after the goodwill posting is complete and validated. Suppression rules ensure that only timely and relevant notifications are sent.

Dynamic Message Content

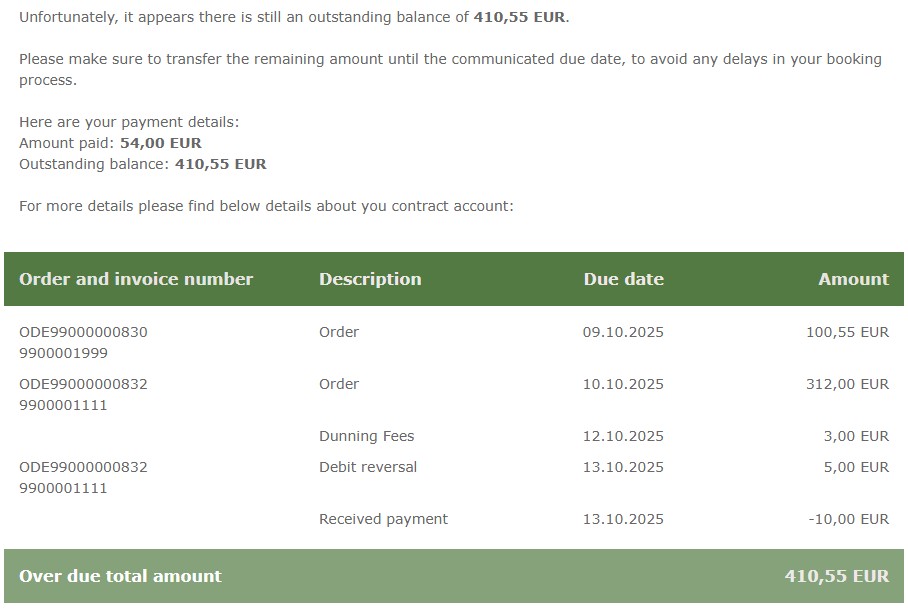

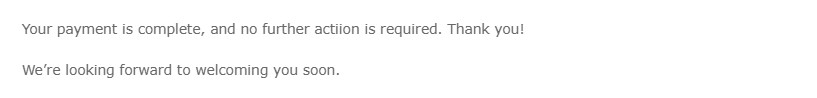

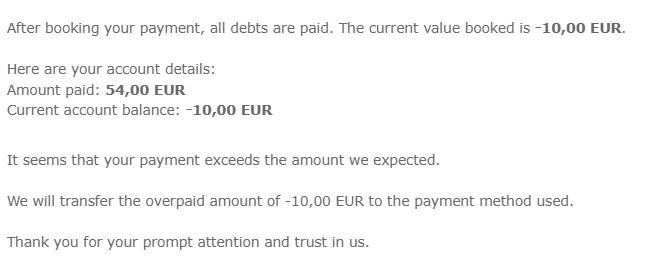

The Goodwill Granted Communication can display different contextual information depending on the updated account status after the goodwill posting:

- Account cleared: Confirms that all open positions have been settled through the goodwill.

- Remaining balance: Indicates that an open amount remains to be paid.

- Refund pending: Informs the consumer that a refund will be initiated.

If an open amount remains after booking the goodwill, an additional overview block with the list of open positions can be displayed.

Text blocks for these cases can be freely defined within each client’s template.

Clients may also include marketing content (such as links or call-to-action buttons) that can be tracked to measure engagement.

Sample for Account cleared:

Sample for Remaining balance:

Sample for Refund pending:

Customization Options

Clients can configure and personalize the Goodwill Granted Communication to align with their tone of voice, branding, and regional setup:

- One goodwill template per language and company code (legal entity).

- Option to create different wordings even for the same language (e.g., Dutch BE vs. Dutch NL).

- Fully white-label design (colors, logos, layout).

- Configurable text blocks for different account outcomes (cleared, remaining, refund).

- Optional marketing elements or links to support brand messaging or next-step guidance.

- Template content and structure are responsive and optimized for both mobile and desktop views.

Event specific parameters

Accounting as a Service provides a general list of parameters that are communicated for all consumer communications which are documented here.

- Total goodwill amount: Total goodwill credit amount applied to the consumer account.

- Total remaining amount:

Open position - based parameters (only if a remaining amount is noticed)

- Type of entry: This allows to specify and localize what kind of entry is displayed

- Invoice

- Dunning fee

- Payment related fees (chargeback/declined direct debit)

- Akonto booked payments (not yet cleared)

- Due date: Date until when this open position has to be paid

- Document date: Date when the position was initially booked (usually the invoice date or the date, the decline fee was booked)

- Order number: Order ID, known by the customer, the position relates to. This information is provided in the create order details

- Invoice number: Invoice number known by the customer, the position relates to. This information is provided in the invoice order details