Payment Received Communication

Within Accounting as a Service, the Payment Received Communication informs consumers proactively when their payment via bank transfer has been successfully received and booked.

This message provides transparency and assurance that the transaction was processed correctly — reducing consumer uncertainty and preventing customer service inquiries such as “Has my payment arrived?”.

By confirming the payment event automatically, businesses enhance trust and provide a smooth, modern post-payment experience.

Key Benefits

Proactive transparency

Consumers receive a confirmation immediately after a successful payment booking — reducing inbound customer service contacts.

Trust through automation

The message reassures consumers that their payment has been applied to their account correctly and that their outstanding balance is updated.

White-label customization

Design, branding, and tone can be fully adapted to your corporate identity.

Responsive and mobile-ready

Templates are optimized for viewing on both desktop and mobile devices.

Trigger and Logic

The communication is triggered automatically when a payment has been booked in Accounting as a Service.

Suppression Rules

- Disabled if the consumer’s account has a collection flag.

- Disabled if the booking is older than 72 hours to avoid sending outdated information.

The message is generated only when the booking data is complete and validated. Suppression rules ensure that no outdated or incorrect notifications are sent in case of temporary system interruptions.

Dynamic Message Content

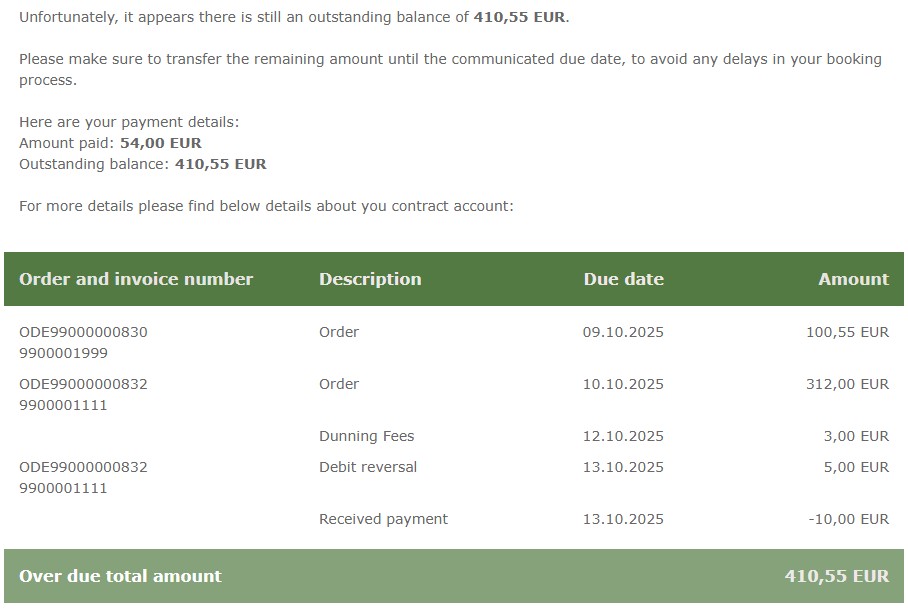

The Payment Received Communication can display different contextual information depending on the account situation:

- Account cleared: Confirms that all open positions have been settled.

- Remaining balance: Shows the outstanding amount that remains after the payment and explain, where it comes from.

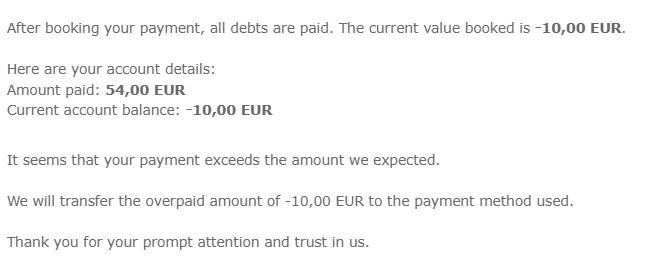

- Refund pending: Indicates that an overpayment was received and that a refund will be initiated.

These variations are populated automatically based on the consumer’s contract account status within Accounting as a Service.

Sample for Account cleared:

Sample for Remaining balance:

Sample for Refund pending:

Event specific parameters

Accounting as a Service provides a general list of parameters that are communicated for all consumer communications which are documented here.

The following parameters are provided by Accounting as a Service and can be used to personalize the Payment Received Communication template.

Clients can decide which of these parameters to include in their message text or design.

- Booking date: Date when the paymetn was booked as received.

- Total received amount: Total amount booked as received in the process, formatted according to local language and currency standards (e.g., currency symbol position, decimal separator).

- payment reference: Original payment reference from the bank transfer or payment transaction.

- current date: Date when the communication was created (this may help customer service later on when customers request updates)

- remaining amount: Remaining amount after booking the incoming payment. This can be positive (remaining open amount), zero (balance cleared), or negative (refund due).

In case of a remaining amount, Accounting as a Service will also provide:

- payment advice: Reference to be used by the consumer in case of transferring the remaining amount.

If additional parameters are required, they can be implemented as part of a custom extension during the onboarding phase.