API Overview

The Different APIs

Riverty's Recurring Payments product utilizes 4 different APIs, 1 is required while 3 are optional:

-

Customer API: This required API creates and manages the consumer profiles which can then be signed up for merchant subscriptions

-

Subscription API: This optional API creates the subscription product or service which a consumer purchases. This API is required if the merchant does not connect a 3rd party subscription management software with the Partner Financing API.

-

Partner Financing API: This optional API allows you to integrate Riverty's Recurring Payments product with an existing third party subscription management software

Regardless of which combination of the above listed APIs is used, two processes are required:

-

All merchants must Generate a Token to gain access to Riverty's APIs every time a consumer is created

-

All consumers must undergo a Consumer Risk Check

The remainder of this page explains the general process flow of the recurring payments product and the difference between using the Subscription API versus using the Partner API.

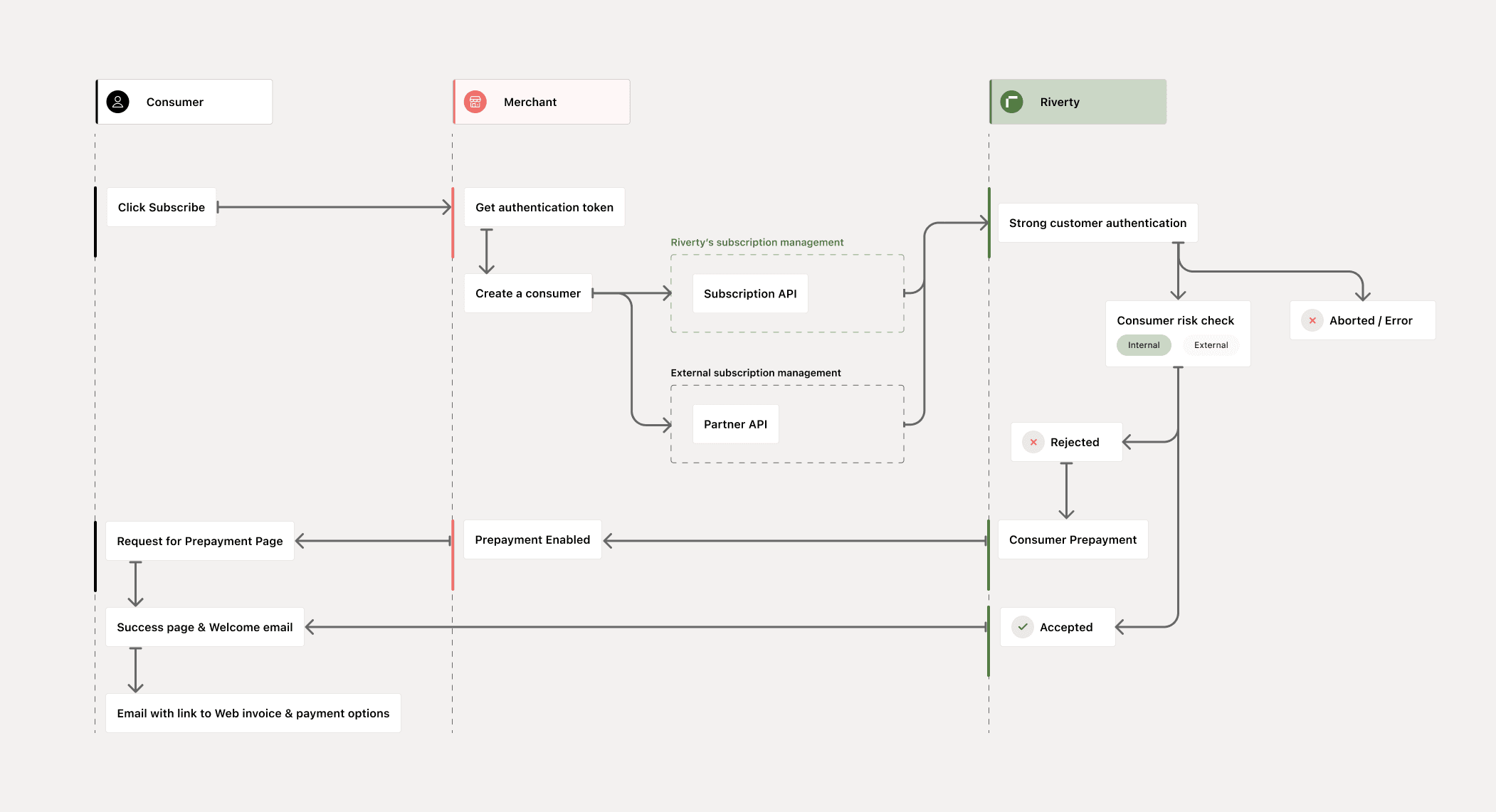

The Process Flow

The Recurring Payments process begins when the consumer has completed the merchant checkout process.

Via the Generate Token operation the merchant obtains a token that allows them to connect to the Recurring Payments APIs. After obtaining a valid token, the merchant is able to create a new consumer via the Create a Consumer call to the Customer API. This consumer profile provides the required information Riverty needs to conduct a Consumer Risk Check later in the process.

The consumer information is now passed through either the Subscription API or the Partner Financing API to create subscription details. More explanation in the sections below.

A consumer risk check is then conducted using the consumer and subscription details. Riverty uses internal and external data to conduct its risk check. Some consumers may be subjected to SCA Validation before a subscription is accepted. Consumers who fail the risk check are subjected to a pre-payment flow. Meaning, they will need to pre-pay their first subscription period before the subscription is accepted [insert link to pre-payment].

Consumers that are accepted will receive a welcome email from Riverty informing them about the successful creation of their subscription and introduction to the Riverty Web Invoice.

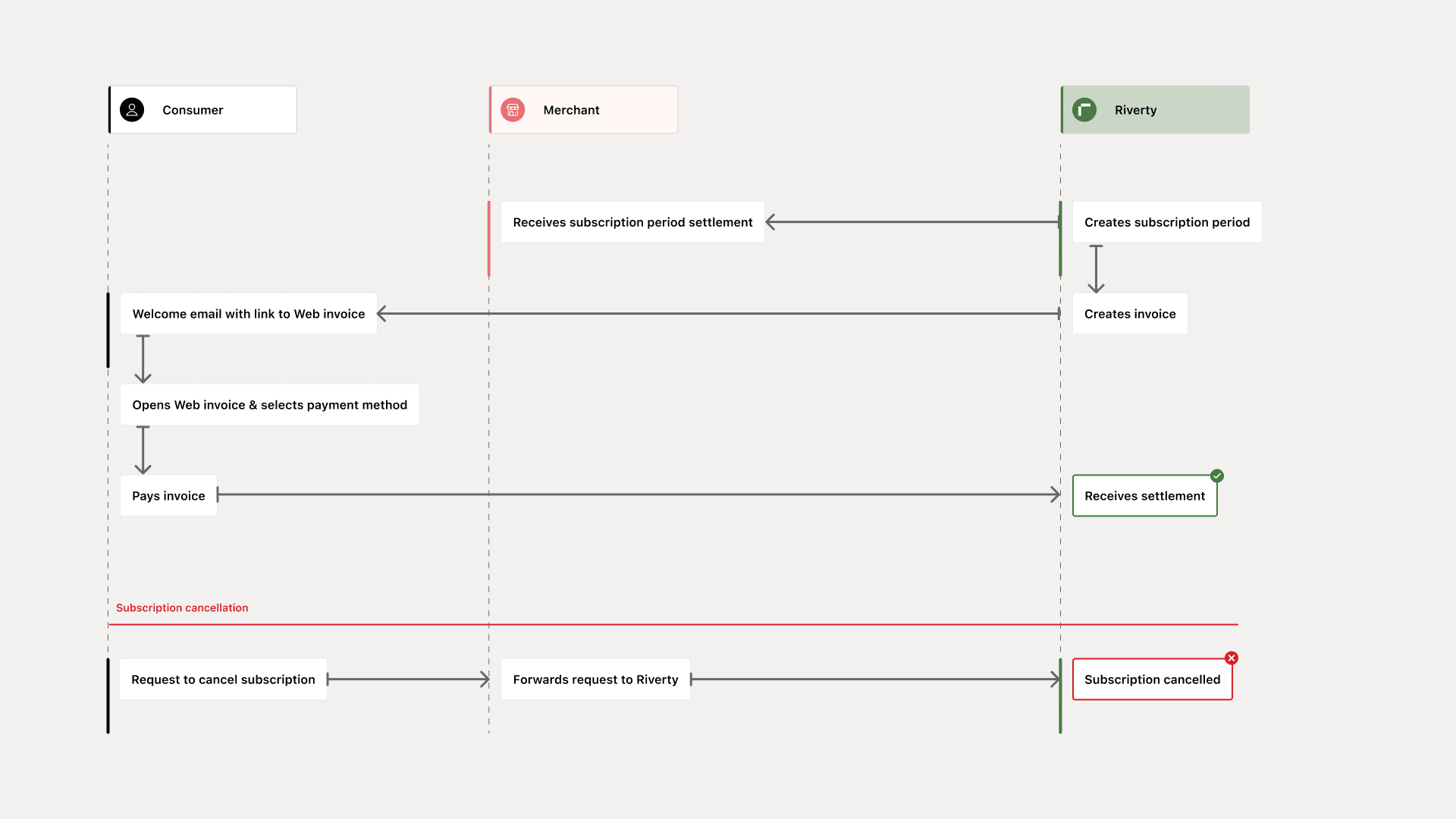

The Subscription API

The subscription API makes use of Riverty's own subscription management engine. When using the Subscription API, Riverty will control the automatic renewal of subscription periods and invoicing of consumers in accordance with the configuration set in the Subscription Product. Riverty purchases the invoice, settles the funds with merchant, and starts the consumer invoice process upon the start of each new period.

When the invoice date is reached, the subscription engine automatically generates the subscription invoice and sends it to the customer via email, complete with an attached PDF copy. This email invites the customer to visit the web invoice to submit payment.

This process is repeated until a cancellation request is received from the merchant. The cancellation is processed based on the cancellation policy defined under the subscription product.

Note: When using the Subscription API, it is first required to set up the Subscription Product before consumers can sign up for a subscription.

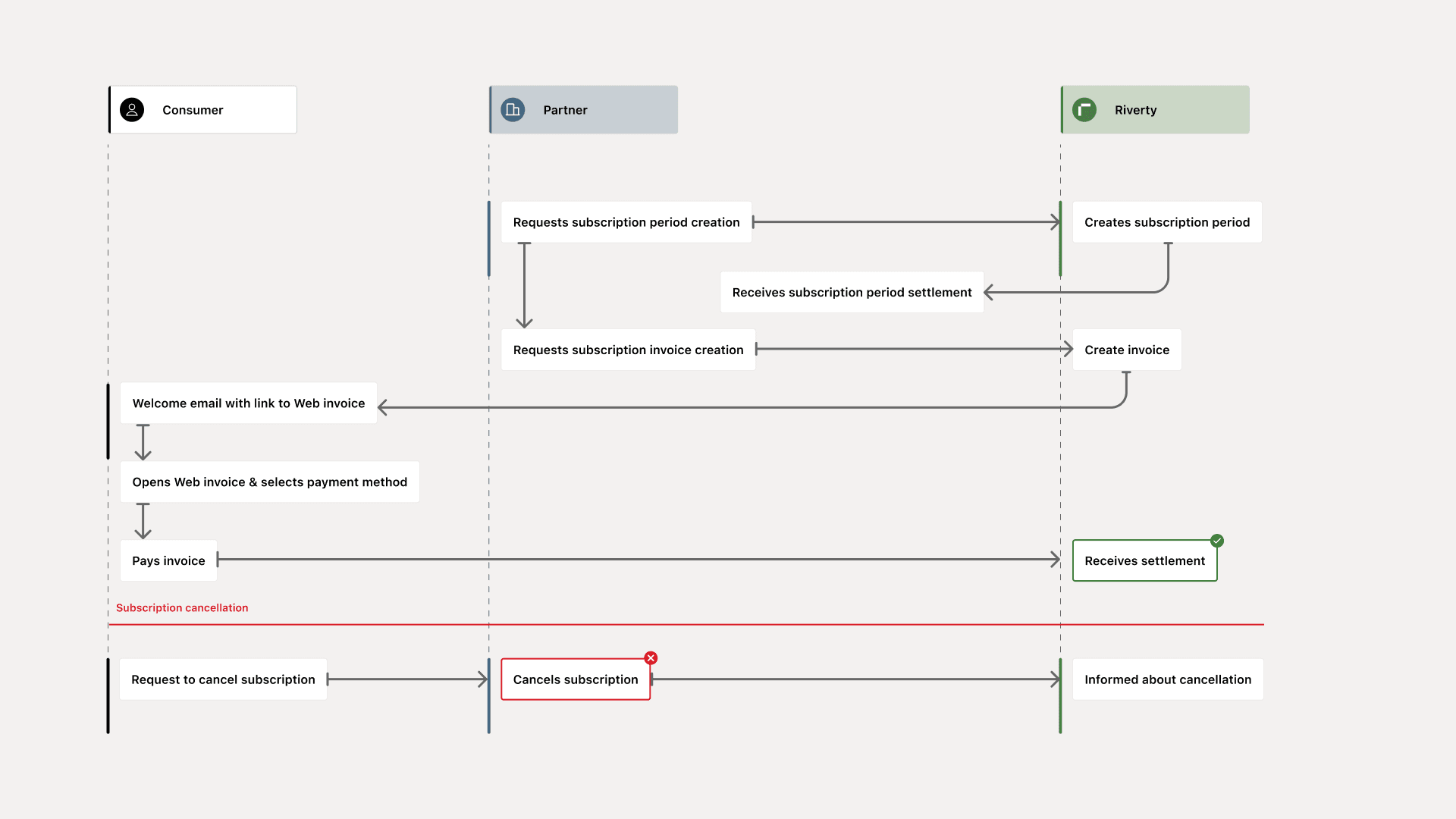

The Partner Financing API

The Partner Financing API is designed to make use of external subscription management capabilities to trigger the subscription period and invoice creation. This allows Recurring Payments to be compatible with partners that have built their own subscription engine or make use of subscription SaaS solutions.

After the subscription is created, a Subscription Period needs to be created. Based on the creation of a new period, Riverty purchases the new period and settles the funds to the merchant. The length of the period can be specified to match each subscription use case.

When the invoice date is reached the partner subscription management system performs the Create an Invoice operation. This triggers the creation of the consumer invoice, distribution via email of the invoice and starts the payment collection process. Invoices can only be created between the start and end date of a period. Periods that are left un-invoiced when the period is ended will trigger a re-purchase of the period amount. Riverty will invoice this period back to the merchant.

This process continues until the consumer cancels the subscription via the cancel partner subscription operation. Once a subscription is cancelled, no future periods can be raised for this subscription.