Configure Risk Check

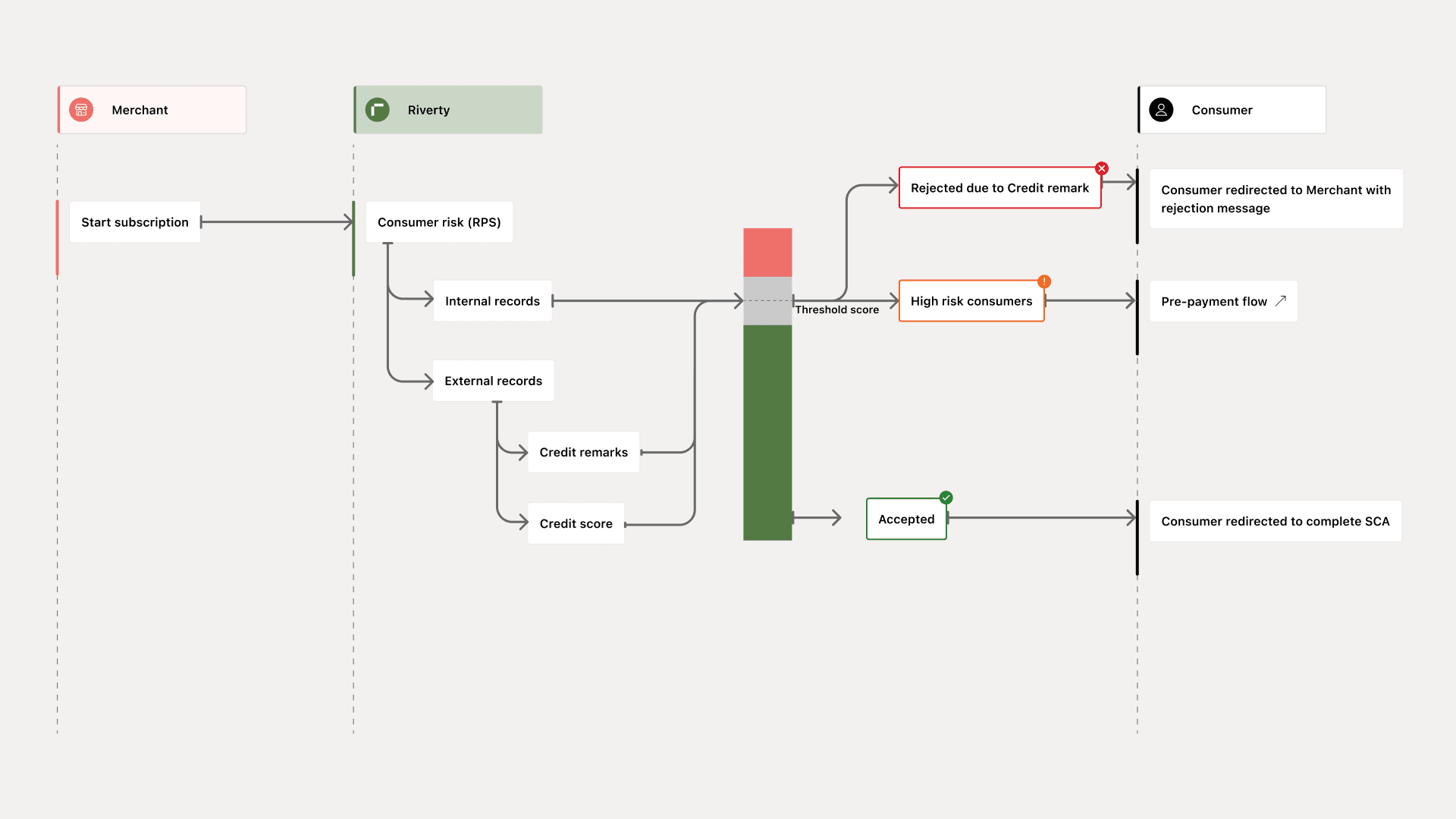

Riverty conducts consumer risk checks at the start of each new subscription, utilizing data from the Create Consumer and either the Subscription API or the Partner Financing API. These checks combine internal and 3rd-party data to assess risk. Consumers accepted by our risk engine are not subject to further checks during their subscription, except for those in a debt collection process. For invoice details, refer to Invoice Process.

Risk Check Configuration Options

Strong Customer Authentication

Riverty requires Strong Customer Authentication via Social Security Number to complete its risk check for Nordic (Norwegian and Swedish) consumers.

If you already capture SSNs, please review our Strong Customer Authentication Page.

If you do not currently capture SSNs from consumers, or are unwilling to transfer SSNs to Riverty, please review our SCA to Capture SSN Page.

Prepayment

Riverty organizes rejected consumers into strict rejections and threshold rejects. In order to provide the highest approval rate possible, Riverty allows merchants to choose whether to provide threshold rejections the opportunity to prepay for their subscription. Prepayment allows you to capture additional sales, prevents consumers from financially overextending themselves, and minimizes Riverty’s risk. Please see our Prepayment Page for more information