Accounting Documents

Introduction

To simplify accounting procedures and help you with bookkeeping and VAT reporting we provide you:

- Riverty Invoice

- Riverty Invoice Appendix

Please note: All accounting documents can be accessed via Riverty Merchant Portal. Alternatively, files can be delivered to the email.

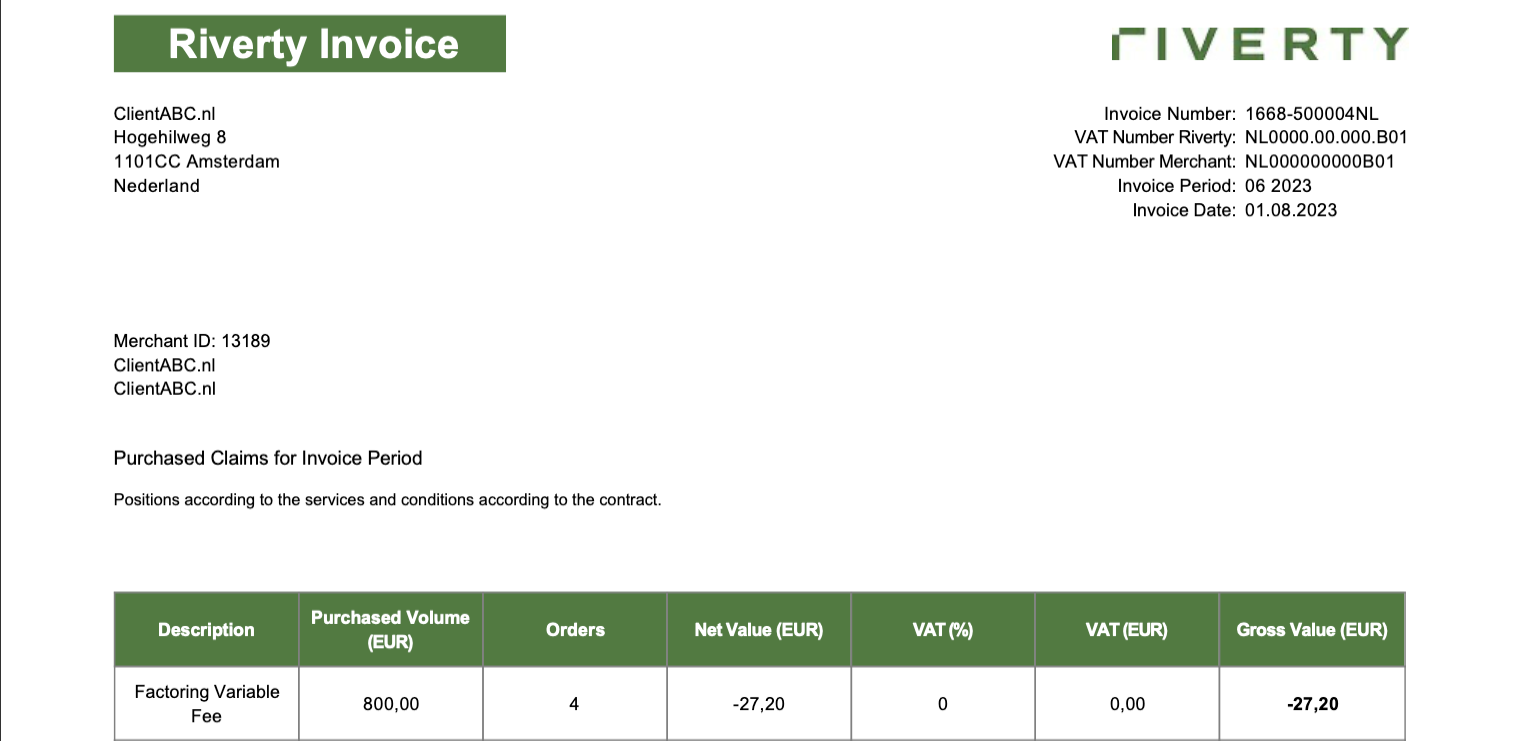

Riverty Invoice

Naming Convention: API_CompanyName_MerchantID_DocumentNumber_CreationDate.pdf

Example: API_ClientABC.nl_13189_1791106_2023-08-01.pdf

Format: PDF

Date Sent: Once a Month, after accounting month closure.

Sample file: API_ClientABC.nl_13189_1791106_2023-08-01.pdf

The Riverty Invoice gives an overview of all purchased claims throughout the last month in a pdf format. Positions on the Invoice are according to the services and conditions agreed within the Riverty contract. The invoice amount is due immediately and without deduction. Unless otherwise agreed, the amount has been deducted from the settlements. For a transactional overview of all purchased claims during the Invoice Period please refer to Riverty Invoice Appendix.

Payment Details

The Invoice Details be a reference for you to keep track of all Riverty Invoices.

The Invoice Period, many times known as the Accounting Period, will define for which term this Invoice is applicable for. It also includes your VAT Number Merchant / Partner to enable you to get back your VAT from your respective tax authorities.

If the VAT Charge is shifted towards the Merchant / Partner, the invoice will contain an additional comment: “Reverse charge of VAT has been applied on this invoice.”

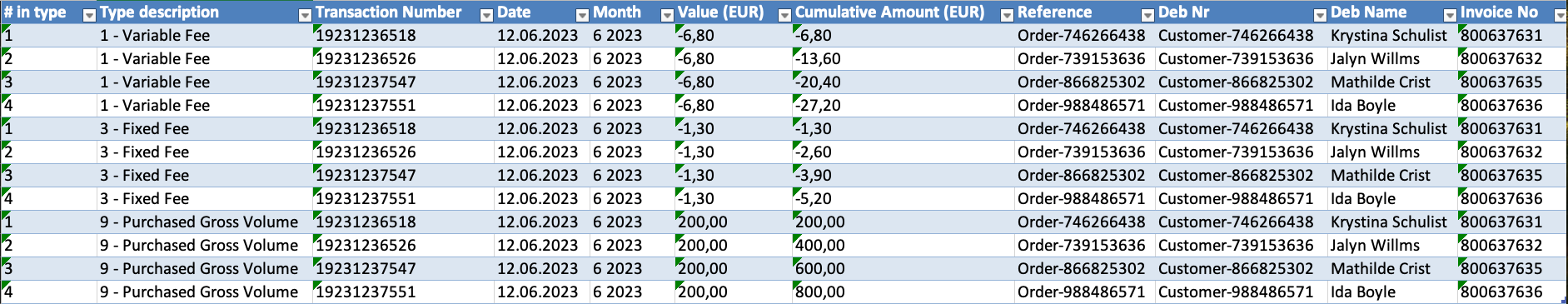

Riverty Invoice Appendix

Naming Convention: APIA_CompanyName_MerchantID_DocumentNumber_CreationDate.xlsx

Example: APIA_ClientABC.nl_13189_1791107_2023-08-01.xlsx

Format: XLSX

Date Sent: Once a Month, after accounting month closure.

Sample file: APIA_ClientABC.nl_13189_1791107_2023-08-01.xlsx

The Riverty Invoice Appendix contains a breakdown of the various components put forward on the Riverty Invoice on a transactional level. This document is provided to you in xlsx format.

Do you find this page helpful?