Reconciliation Documents

Introduction

To enable you to match incoming payments from Riverty with your bookkeeping and ERP systems, we provide you with the following reconciliation documents:

- Riverty Electronic Payment Advice

- Riverty Payment Advice

Please note: All reconciliation documents can be accessed via Riverty Merchant Portal. Alternatively, files can be delivered to the email or Riverty SFTP server.

Riverty Electronic Payment Advice

Naming Convention: EPA(ShopID.SequenceNumber.PayOutReference.CreationDate_CountryCode)

Example: EEPA13189.001.22230201754.20231026_NL.csv

Format: CSV

Date Sent: With every settlement run, as per your contract

Sample file: EPA13189.001.22230201754.20231026_NL.csv

For reconciliation purposes we provide you with an Electronic Payment Advice (EPA).

The EPA file contains Comma-Separated Values (CSV) with payment information that occurred during the Payment Advice Period. The EPA file format can be used in a single- or multi-currency environment.

The EPA format consists of two main elements:

- Header: contains consolidated information of the specific EPA file.

- Transactions: details on single or multiple lines with transaction information.

With intermittent rounding to 2 decimals, the total amount of all transaction Payable Net Amounts added up might not be equal to the Payable Net Amount. The Payable Net Amount mentioned in the EPA header should always equal the amount actually transferred to the bank account. The individual line items are rounded to 2 decimals.

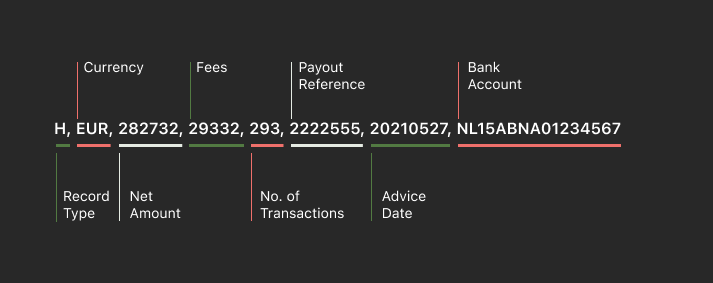

EPA Header

The header is the first row in the CSV file, figure one depicts the header and values.

- The header is the first line within an EPA file and always starts with ‘H’ (for Header).

- The table below describes the other variables in the header and their format.

| VARIABLE NAME | TYPE | DESCRIPTION |

|---|---|---|

| Record Type | String (1) | Constant string with 'H' for Header |

| Payout Currency | String (3) | The settlement currency in ISO 4217, all caps. Example: "EUR" |

| Payable Net Amount | Integer | The total Net amount to be paid out. Example: 282732 for EUR 2827.32 |

| Factoring Fees | Integer | The total amount of fees. Example: 29332 for EUR 293.32 |

| Number of Transactions | Integer | The total number of transactions settled in this batch. Example: 293 |

| Payout Reference | String | A unique payout reference that can also be found in the reference of the bank transfer. Example: 2222555 |

| Payment Advice Date | YYYYMMDD | The date of the payment advice. Example: 20240630 |

| Bank Account | String | The bank account in IBAN format of the merchant to be used for payout. Example: NL15ABNA01234567 |

Please note, the values in brackets stand for the maximum amount of characters.

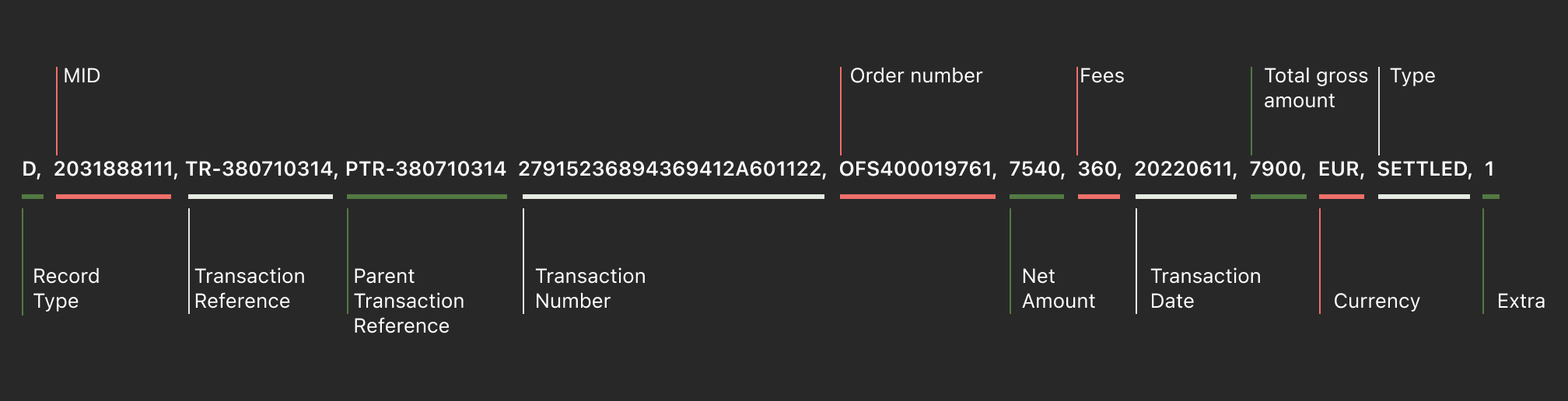

EPA Transactions

Directly below the header line are the transactions. Every line corresponds to one single transaction. The amount of transactions in the EPA file is depicted in the EPA header.

EPA Transaction Details

| VARIABLE NAME | TYPE | DESCRIPTION |

|---|---|---|

| Record Type | String (1) | Constant string with 'D' for Details |

| MID | Integer | The Merchant ID. Example: 12345 |

| Transaction Reference | String (128) | If filled and passed by merchant, we will present it here. Otherwise, this field will be empty (null value). |

| Parent Transaction Reference | String (128) | The parent transaction Reference may be passed by the Payment Service Provider during through the authorization or capture calls. If passed, we will present it here. Otherwise, this field will be empty (null value). |

| Transaction Number | String (20) | Invoice Number (captures) or Credit Note Number (refunds). If not passed, it will be generated by Riverty. Example: 7915236894369412A601122 |

| Order number | String (50) | Order Number related to the transaction. Mandatory API field. Example: OFS400019761. |

| Payable Net Amount | Integer | This should equal the original transaction amount minus the fees (calculate first, then round to two digits after the decimal point). Two digits in the fractional part but no decimal point. Example: 7540 for EUR 75,40 |

| Factoring Fees | Integer | The total amount of all fees including VAT, with two digits in the fractional part but no decimal point. Example: 360 for EUR 3,60 |

| Transaction Date | YYYYMMDD | The date of capture, refund, or other events. Example: 20250511 |

| Total Gross Amount | Integer | The original transaction amount, with two digits in the fractional part but no decimal point. Example: 29950 for EUR 299.50 |

| Currency | String (3) | The original transaction currency in ISO 4217, all caps. Example: EUR |

| Type | String | SALE - Indicates sale transaction. REFUND - Indicates refund transaction. DEPOSITCHANGE- Can be positive or negative amount. When positive: the total holdback amount, presenting the amount that Riverty is holding back (rolling reserve). When negative: the total release amount, presenting the amount that Riverty is releasing, which was previously held back due to the credit limit. CHARGEBACK - disputes, where merchant is obliged to refund the customer (e.g. Fraud or goods not delivered) DISPUTE - dispute fee related to chargeback. VATCLA - VAT claim back. If an Invoice is irrecoverable in Debt Collection, this invoice will be written off. The VAT of this invoice will be subtracted in the Settlement. You'll receive a separate document that can be used to recover the VAT by the Finance Authorities. OTHER - other types that are not covered by any above listed, e.g. manual correction. |

| Extra | String | Space for additional information (optional) |

Please note, the values in brackets stand for the maximum amount of characters.

Riverty Payment Advice

Naming Convention: PaymentAdvice_ShopID_PayoutReference_DocumentNumber_CreationDate

Example: PaymentAdvice_13189_22230201754_1829728_2023-10-26 1.pdf

Format: PDF

Date Sent: With every settlement run, as per your contract

Sample file: PaymentAdvice_13189_22230201754_1829728_2023-10-26.pdf

The Riverty Payment Advice shows the balance of what will be paid out by Riverty during the Settlement Period (time between previous and the current settlement), as defined by the contract.

Payment Details

The Payment Details will specify when the funds are being transferred to you as a merchant and indicate which reference will be used in the money transfer as well as the payment date.

The Payment Advice Period, will define for which term this Payment Advice is applicable for. The Receiver Account shows to which IBAN the funds will be transferred.

Merchant Clearing Account

The Merchant Clearing Account (A2980) will indicate how much will be paid out to you at the end of the period. Be aware that a negative “Out Balance” will be transferred to next Payment Advice Period. Receiving the paid out funds can take up to 3 (three) days depending on bank.

On this document you can find balances on an aggregated level of all Purchased Gross Volume, Refunded Volumes, Fees, Refunded Fees, Goodwill and Additional Fees, including respective VATs.

Transactions

The Riverty Payment Advice also shows the components within the Merchant Clearing Account (A2980) broken down on a transactional level.

Do you find this page helpful?