VAT Reclaim for Bad Debt Losses – A Guide for Merchants (BNPL Transactions with Riverty)

As a merchant working with Riverty as your Buy Now, Pay Later (BNPL) provider, you sell goods or services and transfer the receivable to us. The VAT is already included in your invoices and remitted to the tax office. However, when a customer fails to pay, and the claim becomes uncollectible, you are entitled to reclaim the VAT already paid, as per:

- Germany: §17 (2) Nr.1 S.1 UStG

- Austria: §16 (3) Nr.1 S.1 UStG 1994

- Switzerland: Art. 41 (1) MWSTG; (MWST-Info 04, 2.7.2.2)

What is Bad Debt?

Riverty, as your BNPL provider, handles debt collection on your behalf. If a receivable is deemed uncollectible, Riverty will write it off. This is considered Bad Debt, and in this case Riverty will claim VAT of the affected receivable back from the merchant. Consequently, merchant can claim back the very same VAT amount from the tax authorities.

How does the merchant get informed?

Affected amount is included in the payout calculation. Settlement files contain affected records, identified as transaction type VATCLA. This ensures merchant is immediately informed.

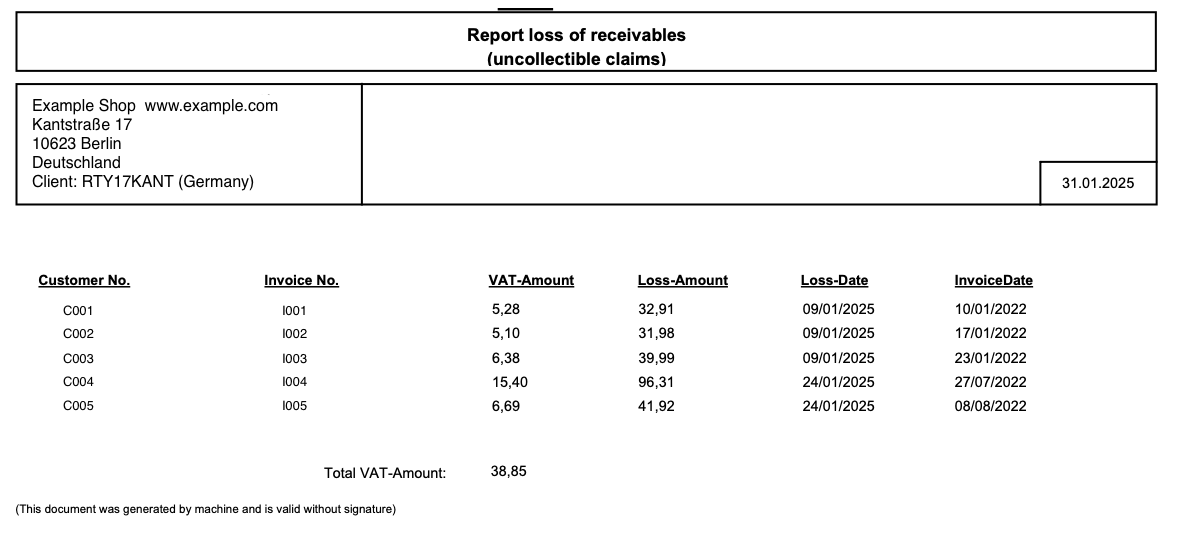

At the start of the next month Riverty send separate email containing all VATCLA records. Sample document:

What to Do After Being Informed by Riverty?

- Review and import VATCLA transactions from the settlement files provided by Riverty.

- Update your accounting records accordingly

- Record the VATCLA transactions in your accounting system

- Gather Required Documentation:

- Original invoices issued to the customer

- Proof of the receivable write-off by Riverty

- Communication records with Riverty regarding the VATCLA transactions

- Copies of your VAT returns where the original VAT was declared

- Adjust Your VAT Return

- Adjust your VAT return to reflect the VAT reclaim. Include the VATCLA amounts in the appropriate section of your VAT return form.

- Submit to Tax Authorities

- Submit the amended VAT return along with the required documentation to your local tax authority.

Do you find this page helpful?