Consolidated invoice for retail

Product Introduction

Consolidated Invoice bundles smaller purchases into one single invoice and is most used as a ‘monthly invoice,’ typically suitable for retail/marketplace providers where users shop regularly. But the frequency of the invoicing can be agreed separately.

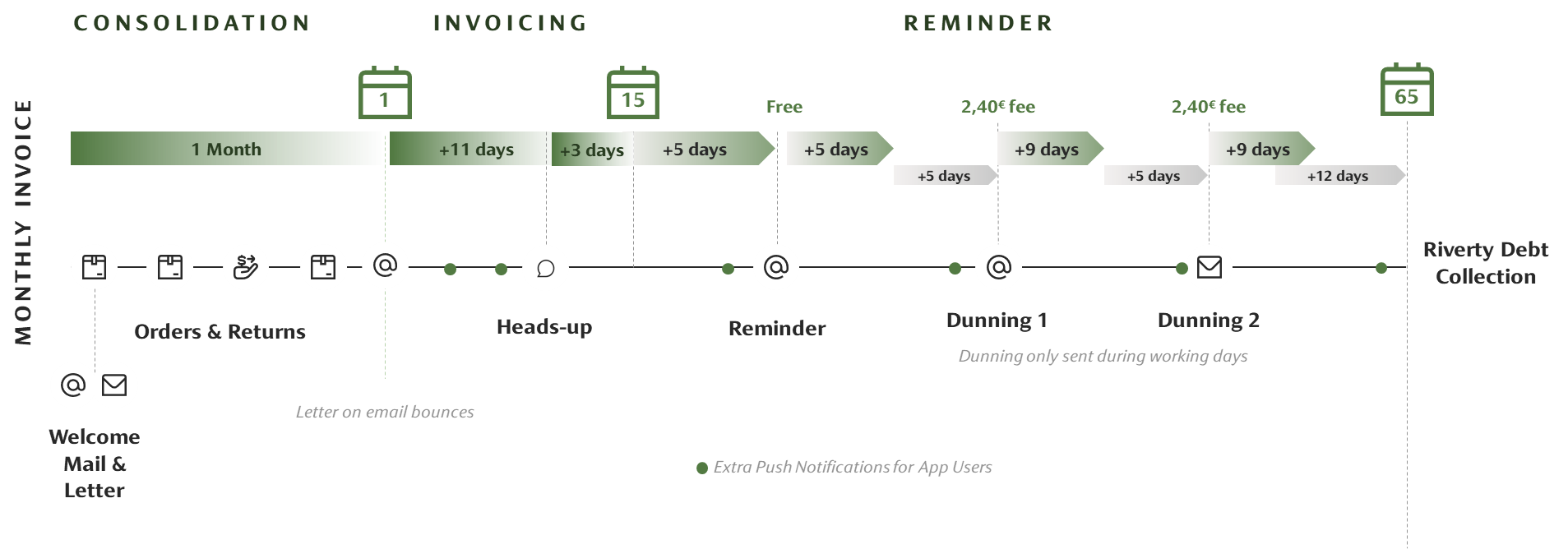

The payment term starts from the date on which the consolidated invoice is issued, usually at the end of the month. Each order added is evaluated separately, added to the customer account statement over the period, and consolidated into one invoice at the end of that period. Hence, for the consolidated invoice two main time periods can be defined:

• Running statement: activities during the consolidated invoice period (orders, returns, disputes)

• Final statement and invoice: activities after consolidation period have ended (payment, new orders, returns, disputes)

Customer journey

Throughout the month, a customer makes multiple purchases from an online marketplace or retail service. Each transaction is recorded and added to their account. At the beginning of the following month, all accumulated transactions are consolidated into a single invoice, which is then issued to the customer with 14 days to pay. This allows the customer to manage their expenses more efficiently by making one consolidated payment instead of multiple smaller ones. Customers also have the option to return their purchases, and if a dispute arises, it will be reflected in the summary of purchases, ensuring transparency in the final invoice. If the customer misses the payment deadline, Riverty sends multiple reminders to encourage timely payment and prevent the initiation of the debt collection process. The schedule and reminder timelines depend on the specific market regulations and business practices. Meanwhile, the merchant benefits from a guaranteed payout and streamlined settlement reports, ensuring smooth financial operations. Example of the customer journey in Germany:

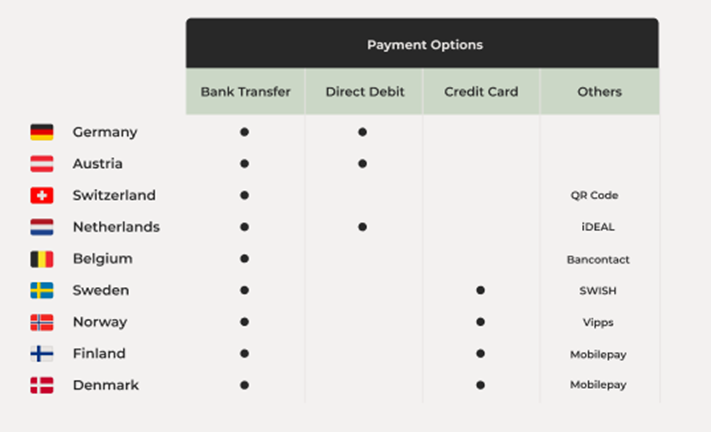

Customers can pay their Monthly Invoice with various payment methods in different markets:

Checkout

To ensure Riverty performs optimal in your checkout, please follow these best practises on how to present Riverty in your checkout and displaying the required Terms & conditions and privacy statements..

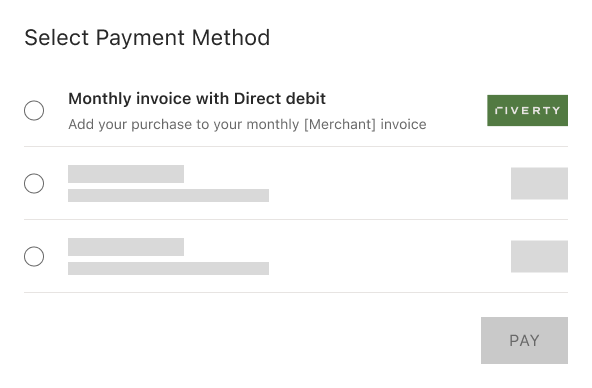

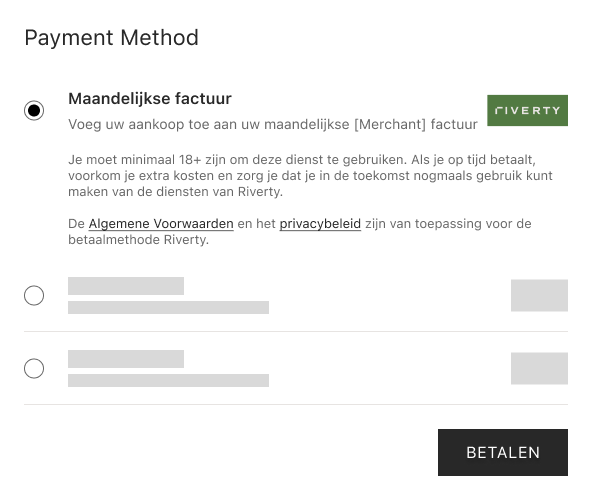

Example of checkout representation of Monthly Invoice:

In English

In Dutch

How to Integrate

Clients can integrate with the Monthly Invoice solution through three methods: direct integration, plugin integration, or via a Payment Service Provider (PSP). These options provide flexibility for businesses to choose the most suitable integration approach based on their technical capabilities and operational needs. For Riverty to perform an effective risk evaluation, it is essential to receive the necessary information from the client, which is transmitted through the authorization API call.

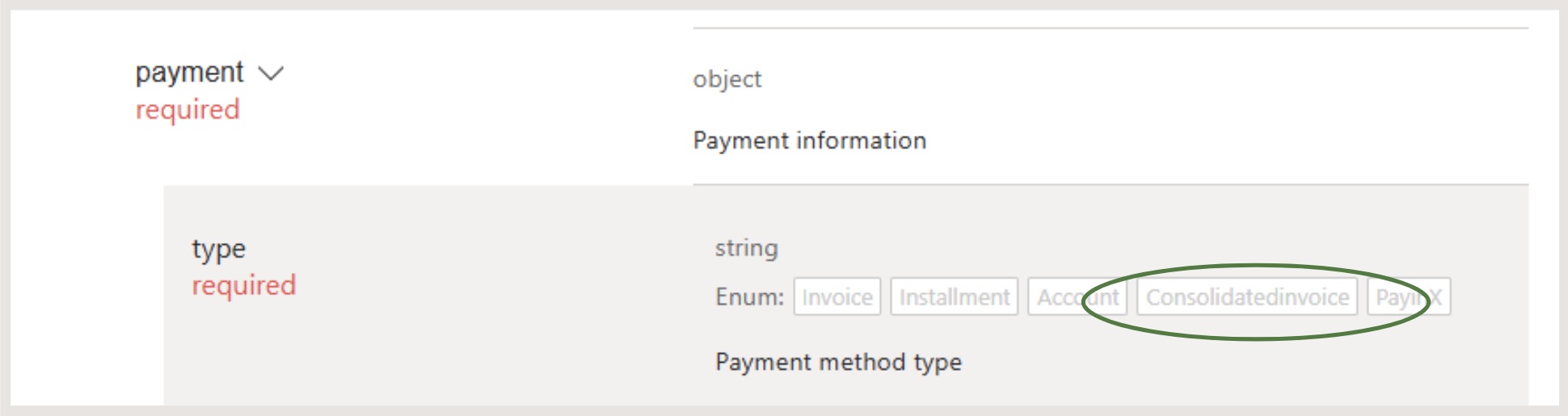

It is important that in API calls the payment type specified as "Consolidated invoice":

How To Start Integration

Start With One of Riverty's Integration Guides

- Start Integration

Platform/Plugin Integration

Integrate via Webshop Platform provider

- Start Integration

Direct Integration

Setup Custom Developed Connection

Do you find this page helpful?