Customers can add their purchases to Consolidated Invoice.

| Service | Details |

|---|---|

| Geographic coverage | DACH, Nordics, Netherlands |

| Consumer communication | E-mail, app, web portal, phone, chat, chatbot, social |

| Customer self-service options | App |

| Reliable merchant support | merchant service desk, merchant portal, 24/7 monitoring service |

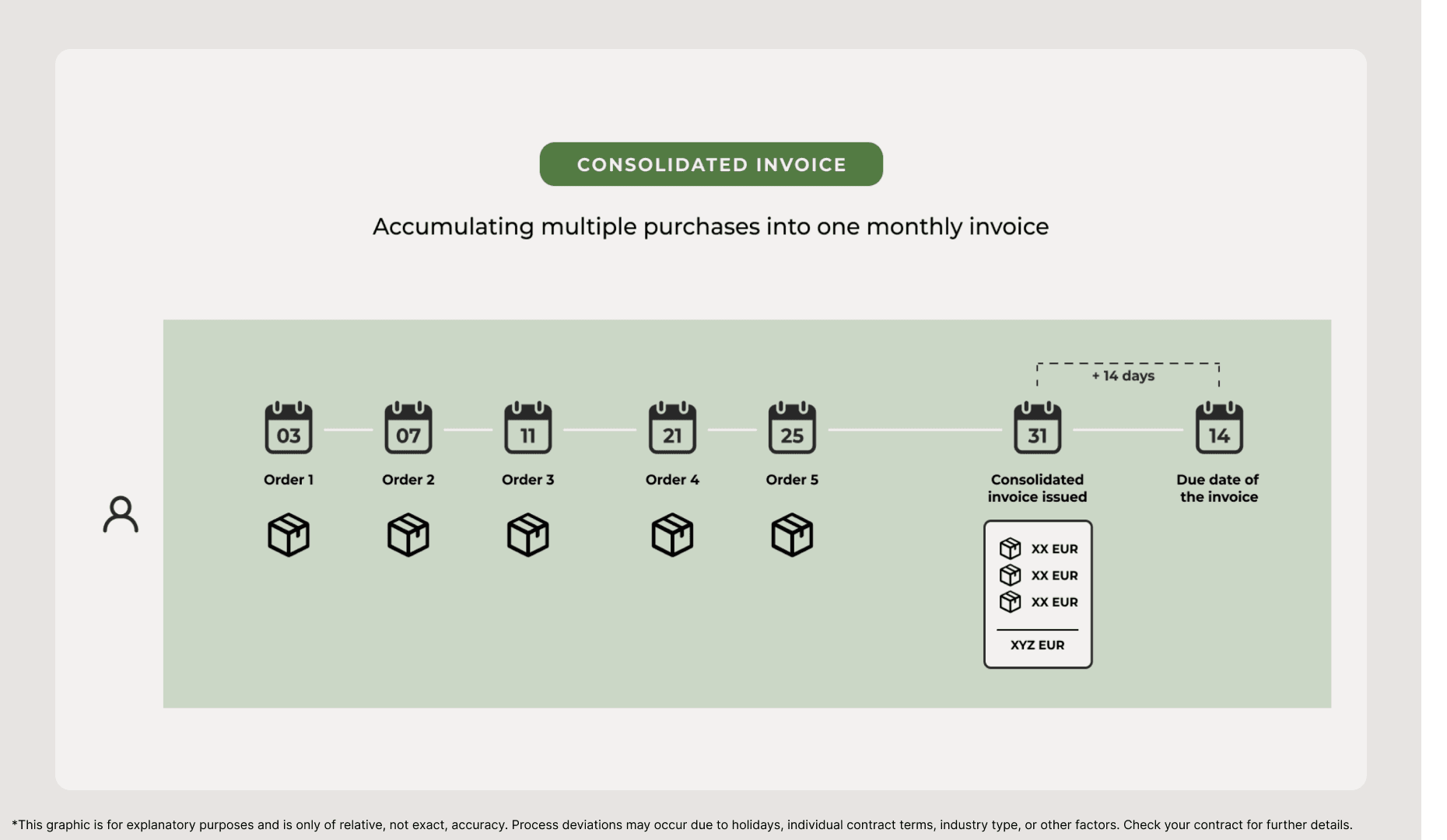

Riverty Consolidated Invoice is a payment solution designed for frequent shoppers, offering convenience at checkout while driving higher customer loyalty and revenue for merchants. Consolidated Invoice bundles smaller purchases into one single invoice and is most used as a ‘monthly invoice,’ typically suitable for transportation tickets or digital streaming services as well as retail/marketplace providers where users shop regularly. But the frequency of the invoicing can be agreed separately.

The payment term starts from the date on which the consolidated invoice is issued, usually at the beginning of the month connected to the salary schedule of consumers. Each order added is evaluated separately, added to the customer account statement over the period, and consolidated into one invoice at the end of that period. The most frequeant period for the consolidated invoice is monthly period.

At checkout

Customers select "Pay by Monthly Invoice" as a payment method, agree to the terms, and complete the purchase.

Each order is evaluated and combined into a single invoice, typically issued first of the month.

Post-purchase management

Customers track and manage their spending through Riverty’s app, consolidating purchases from different transactions into one invoice.

Payments are due by 15th of the following month, offering customers financial flexibility.

Convenient Checkout: Streamlines payment processing by consolidating multiple purchases into one invoice, making transactions quicker and easier.

Expense Control: Helps manage finances effectively by reducing multiple small payments into a single due amount, improving budgeting and financial oversight.

Improved Organization: Provides a clear overview of spending, allowing consumers to track purchases, review detailed information, and identify discrepancies easily. This enhances personal finance management.

Fewer Missed Payments: Reduces the risk of missing a payment and incurring late fees by minimizing the number of transactions and invoicing customers in a predictable pattern.

Throughout the month, a customer makes multiple purchases choosing Monthly Invoice as a payment option. Each transaction is recorded and added to their account. At the beginning of the following month, all accumulated transactions are consolidated into a single invoice which can be paid with different payment methods depending on the country. The customer receives the invoice and makes one consolidated payment, simplifying their financial management. In case, customer has not paid untill deadline, Riverty sends multiple reminders to encourage timely payment and to avoid the initiation of the debt collection process.

Consolidated Invoice is listed just like any other payment method allowed by the merchant. When the customer decides on "Monthly Invoice", the customer must simply agree to the general T&C for Consolidated Invoice and is asked to read the privacy policy. The customer then clicks ‘PAY BY MONTHLY INVOICE’ to complete the check-out process.

Higher Average Spend: Typically, 3–4 orders are consolidated into a single invoice (for retail), increasing the overall purchase value.

Increased Purchase Frequency: Customers using consolidated invoicing make purchases 15% more frequently.

Guaranteed Payouts: Ensures secure and simplified settlements, reducing the risks associated with multiple individual transactions.

Clear Settlement: Instead of having to recieve payment from many customers, merchants receive payment from Riverty. Riverty in turn provides both Itemized Settelment Documents and Consolidated Settlement Documents.

Riverty Consolidated Invoice is ideal for:

Be sure to sign up for a Riverty Merchant Portal Account! Individual transactions are managed through the Merchant Portal, along with access to many other features like financial reports and branding.

The Merchant Portal Guide provides a full tour.

Start With One of Riverty's Integration Guides

Platform/Plugin Integration

Integrate via Webshop Platform Provider

PSP Integration

Integration via a Payment Service Provider (PSP)

Direct Integration

Set Up a Custom Developed Connection